Investment summary

I believe Nextage offers an attractive return for two reasons. One is the structure of the industry in Japan and the second is the negative media coverage that plummeted the company.

As for the first point, used car retail business in Japan is different from the one in the US as cars need to go through safety checks by government certified body shops every two years. This creates repeat customers that are likely to come back for inspections after a purchase.

As for the second point, investors shunned the sector after the negative press coverage. However, I believe the customer memories will fade (I am thinking of the data breach in Equifax and #deleteUber) and they will purchase used cars based on value propositions (low price and good service). If so, Nextage will resume growth and its valuation should re-rate.

Used car sector has been in a tailspin since July 2023 when media reported that Big Motor, one of the largest privately-owned used car retailers, filed bogus insurance claims from its repair shops, charging excessive insurance payout from insurers. Then in August, it was reported that Nextage employees filed bogus claims to the company to meet key performance indicators which were essentially taken as quotas. It did not help that the then-CEO of Nextage, promoted in February 2022, joined from Big Motor in 2016. The CEO resigned in September and the founder came back. Also in September, Good Speed (7676), a much smaller player in the industry, disclosed that it had been inflating sales by recognizing contracted but not handed over vehicles as revenue.

Although Big Motor’s and Nextage’s behaviors sound similar on the surface, the type of misconduct is completely different in my view. In Big Motor’s case, it is a fraud. Insurance companies paid inflated claims, and the car owners ended up paying higher premiums as a result. On the other hand, Nextage’s issue was about code of conduct. For example, Nextage salespeople offered discount to the retail price in exchange for the buyer joining insurance and solicited buyers to sign up for a tire exchange program (replacing busted tires with new ones for free) by suggesting that the salespeople can intentionally bust the tires with a nail if needed. The underlying problem of Nextage was the extreme pressure on salespeople to achieve key performance indicators, which determined promotions. Banks supporting the auto retailers’ working capital understand the difference and continued to support Nextage, whereas they withdrew financing from Big Motor.

Due to the reputational damage, Nextage saw its foot traffic decline more than 20% YoY in October. It failed to beat its already-lowered Q4 (September – November) guidance and investors appear to be skeptical if it could meet its November 2024 guidance. However, with foot traffic turning positive YoY by the end of 2023 and add-on sales rising, I believe the company will post results better than the market currently expects. I estimate that Nextage stock is worth at least Y3,000 per share, based on 13x Nov-24E EBIT of Y22bn. If Nextage’s EV/EBIT multiple returns to its last five-year average of about 15x, the stock can be worth Y3,540. I expect the stock to rise 30-50% in the next twelve months, and more in the following years as the company’s earnings grow at around 20% annually.

Risks to investments

Nextage discontinued incentives from the sales of add-ons around in October. Although company incorporated the resulting lower add-on sales in its guidance, we will not know at which level they will stabilize yet.

The company gives you many seemingly useful numbers in investor presentations, but it is difficult to tie them back to financial statements. It makes me wonder if the management is given a clean picture of unit economics by the finance department.

Used car market: market size and players

Market size

There are no official statistics that track dealer-to-consumer (B2C) used car sales volume in Japan. Japan Automobile Dealers Association and Japan Light Vehicle Association issue used vehicle registration statistics which represent the trade volumes of consumer-to-dealer, dealer-to-dealer, and dealer-to-consumer combined. Light vehicles are vehicles that have engine displacement of less than 660cc and have a lower vehicle tax. They are very popular among Japanese thanks to the lower maintenance cost than passenger vehicles. The table below shows the historical registration volume. You can see that the market has been roughly flat until the new car shortages seem to have hit the used car market in 2022.

Yano Research Institute estimates that the B2C market were 2.7mn units in both 2014 and 2021. Perhaps we can estimate that the B2C market has also been flat.

As for the new vehicle market, Japan Automobile Dealers Association releases new vehicle sales every year and the numbers have been around 5.2mn units per annum before Covid (it was 4.8mn units in 2023). Therefore, used vehicle sales account for roughly 35% (=2.7/(5.2+2.7)) of the retail sales in Japan. This used car sales ratio is considerably lower than in the US or Europe whose ratios are around 60-70%. The low ratio in Japan is attributed to cultural preference over new to used.

Used car dealers can be divided into two categories: car makers’ authorized dealers and dealers that do not have an exclusive relationship. For example, a Toyota-authorized dealer is either directly owned by Toyota or by a third party which has a distribution agreement with Toyota. These authorized dealers account for roughly half of the 2.7mn used car sales market, according to Idom (7599) management, but the size of each player has historically been small compared to the independent car dealers because car makers avoided cannibalization by setting up a territory system where each dealer is assigned regions it can sell. This may change in the future, as Toyota Motor (7203) decided to exit most of its directly owned stores except Toyota Mobility Tokyo whose revenue was Y401bn (including new car sales) for the fiscal year ending March 2023. Toyota Mobility Tokyo is a 100% subsidiary of the Toyota Motor Group and was formed in 2019 by merging Toyota’s five directly owned franchises operating in the Tokyo region. As consolidation within authorized dealers progresses, they may become more competitive.

But for now, the main players in the used car sales industry are the independent dealers who can sell multi brands. Nextage and Idom retailed 155k and 140k units in 2023. That is 11% of the B2C market. I believe both companies have room to grow market shares, given the homogenous regulation and vehicle registration process nationwide.

Why the market is fragmented

I think there are two main reasons: the low barrier to entry and the regional nature of competitions.

One can start a car dealership by obtaining a license. In addition, the condition of a used vehicle varies, and it is difficult to compare purely based on price as we do for new vehicles (the lemon problem). Furthermore, it is difficult to scale quickly – unless you have a large capital as the top players in the industry do – because it will cost around $6-8k to buy a used vehicle and a dealer will need to have at least 50 vehicles ($300-400k total) to attract customers to the store. Floorplan financing does not appear to be common. The lack of capital hinders rapid growth.

Another factor is the nature of the competition. Prospective buyers prefer to see and test-drive in person before they make a purchase. As a result, consumers generally decide the purchase based on the availability within their regions. A vehicle transportation service costs between Y50,000 to Y100,000 nationwide, but it takes about a week to deliver to the nearest drop-off stop (from which the dealer or the buyer needs take it to the door front). Unless the buyer is strongly attached to a certain model, he would prefer a faster delivery, not to mention that he will not be able to test drive in advance. Due to these factors, the nature of competition is local, and once a local dealer establishes a high market share in the region, it has less incentive to go to a new region because it needs to build market share from scratch.

Why I think consolidation will take place / the characteristics of competitive advantage

Although the used car dealership industry has been fragmented, I think consolidation will take place going forward. The main reason is that the largest players in the industry have large enough funding to open new stores quickly, and scale begets scale. The top players do not look at a used-car sale as a one-off transaction and now focus on lifetime transactions with their customers.

It starts when buying a used vehicle from a potential customer. You have a used vehicle seller visiting your store, why not sell her a vehicle as well? In addition, buying a used vehicle offers a less expensive sourcing than through wholesale auctions.

Once you sell a vehicle to your customer, the dealer also sells a maintenance package. In Japan, vehicles go through a mandatory safety check every two years. Safety check is a lucrative business (Nextage books a 46% gross margin from maintenance segment whereas used vehicle sales segment is 16-17%) and keeps in touch with the customer until she is ready to replace the vehicle. As a result, the longer the store operates, the more profitable it becomes because revenue from maintenance services increases as the cumulative number of customer purchases rises. If the dealer successfully locks in a customer, it can spend less on advertising and promotions (A&P). Higher profits from maintenance and reduced A&P spending can be reinvested to lower the selling price.

The dealer with a wider assortment of inventory has an advantage of attracting consumers as they generally search online before visiting a store. This is why some used car dealers focus on one category of cars (e.g. SUVs and import cars). The top players, however, are opening large-size (8,000sqm) stores which, like a department store, have all types of vehicles for better operational efficiency. The maintenance area needs to be of a certain size (it cannot be small just because the store is small) and will have a higher utilization rate if there are more vehicles in need of maintenance. In other words, large stores suit the maintenance service capacity better. Therefore, car dealers prefer to open large-size stores.

The largest constraint to open large-size stores is capital. Typically, a large-size store requires Y500-600mn for fixed assets and Y200mn to have the inventory (Y0.8mn per car times 250 units), which makes the total cost of Y700-800mn. Therefore, small dealers struggle to scale while large dealers can open new stores aggressively.

Nextage Description

History

Nextage was founded in 1996 by the current CEO Yasuji Hirota when he was 23 years old. Hirota changed Nextage’s business strategy a few times. Originally his used car dealership focused on Volvo cars to create a niche. When the competition became more intense as other dealers started imitating his business model, he changed the stores to focus on certain types (e.g. SUVs and large import cars) of cars. The idea presumes that a prospective buyer of a 4WD would only look for SUVs, therefore a large assortment of 4WDs should capture his demand. Around 2008, Hirota came up with an idea of selling vehicles at low margins and instead generating profits from services such as maintenance packages and insurance. And in 2015, the company started focusing on large-size stores. In 2014, Nextage tried an online-only car sales but received feedback from sales force that customers wanted to test drive before making purchases. This made Hirota realize that customers want a wide range of inventories so that they can touch and test in person, leading to large-size stores.

In January 2022, Nextage announced its new mid-term plan. It targets Y500bn of revenue with Y30bn of EBIT by the fiscal year ending (FYE) Nov-24 and Y1trn by Nov-30 with Y90bn of EBIT with the current strategy, that is the roll out of large-size stores with life-time transactions (i.e. maintenance and insurance). It is worth noting that the company has been committed to the strategy for the last seven years and is committed for the next eight years, whereas in the past it has shifted directions every five years.

Please note that for FYE Nov-24, Nextage lowered the EBIT target to Y20bn from Y30bn, despite raising sales to Y545bn from Y500bn, citing the lower-than expected gross profit per vehicle.

Hirota stepped down as the CEO in February 2022 and Koji Hamawaki became the new CEO. Hamawaki resigned in September last year by taking responsibility for the sales tactics made by the salespeople, and Hirota is back as the CEO.

Business description

Nextage is mainly a used car retailer, though it has a new car sales segment which accounted for 8% of gross profit for FYE Nov-23. Nextage has grown its revenue and EBIT at 27.8% and 31.7% CAGR over the last ten years.

As of November 2023, it had 295 stores in 193 locations (some stores are located on the same premise). Nextage’s focus has been to (i) increase the number of large-size stores, while occasionally opening medium-size stores when the company cannot find the right real estate space; and (ii) expand the used car purchase network to source inventories directly from consumers.

In its security filings, Nextage discloses the number of inventories it intends to carry for new stores as a part of its capital expenditure plan disclosure. It also discloses inventory days in investor presentations. By using these two numbers, one can make an estimate of sales volume per certain store format. The table below shows my estimate of sales volume breakdown. Large-size stores are estimated to have accounted for 76% of retail sales volume for FYE Nov-23.

Nextage has ramped up direct purchases from consumers to secure inventories, as you can see that the number of used car purchase shops, which are often operated within the retail shops, has risen rapidly in the table above. In FYE Nov-21, 35% of the retail sales were sourced from consumers, whereas the number went up to 62% in Q4 Nov-23. As the company got better prices from consumers (than from auto-auctions), gross profit per retail vehicle rose from Y450,000 in FYE Nov-21 to Y480,000 in Q3 Nov-23, right before the scandal hit the company reputation.

Economics of the store

Nextage’s return on invested capital has been around 7-10% over the last four years based on its financial statements, however, this masks the real store economics because it takes years for a newly opened store to mature, and the company has been increasing the large-format store count by 30%+ every year. According to Nextage investor presentation, a year-old store has an operating margin of 3.9% whereas a five-year-old store has 8.8%. Though this ‘operating profit’ is management accounting and does not translate to GAAP figures (consolidated EBIT margin is 3-4%, somehow lower than a year-old store), it illustrates the difference of profitability. The reason behind this is that as a store matures, it has more customers who purchased vehicles and bring them in for maintenance.

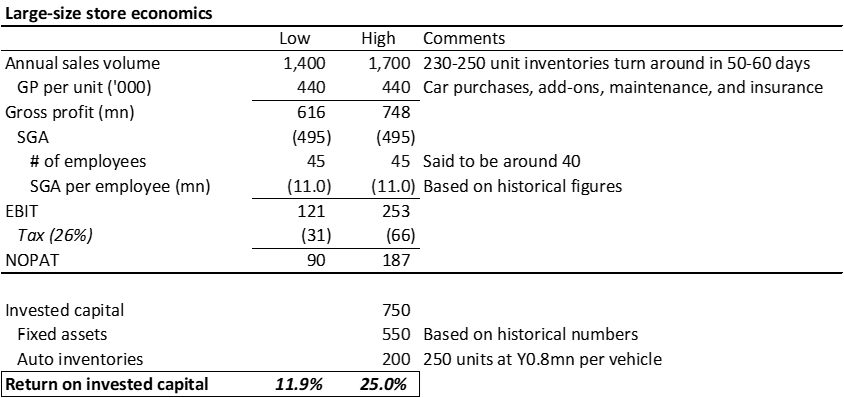

Based on the following assumptions, I calculate that the ROIC of Nextage’s large-size store is 12-25%.

Annual sales volume of 1,400-1,700 units. A typical large-size store has around 250 units which turn around in 50 to 60 days

Gross profit per unit (GPU) of Y440,000. This includes car sales, add-ons (e.g. special coating, tire replacement programs), maintenance, bi-annual inspections, and insurance brokerage fees. The number is in line with the last three years

45 employees working per store

SG&A per employee of Y11mn based on the historical SGA/<average number of employees>

Idom discloses the economics of a large-size store. For Idom, a typical large-size store with a repair center employs around 40 people, sells about 1,000 units, and generates Y130mn of NOPAT annually. Since it costs around Y550mn on fixed asset investments and Y200mn on inventories (Y0.8mn per vehicle x 250 units), return on invested capital is 17.3%(=130/(550 + 200)).

Impact from the new sales strategy

Nextage’s new sales policy is (a) team-based sales approach; and (b) fixed annual salaries with no incentives. Although the company acknowledges that the change will result in lower add-on sales per vehicle, it argues that the loss will be made up by lower churn among employees (=lower training cost) and increased sales volume by presenting better buying experience for customers, who will feel less pressure. It is inevitable that add-on sales will decline given the new sales incentive scheme, or lack thereof. The question is how much. In its Q4 Nov-23 investor presentation, Nextage disclosed that gross profit from add-ons and insurance/auto-loan brokerage fee declined by about 25% QoQ. Based on my calculation, retail gross profit per unit declined from Y481k in Q3 to Y423k in Q4.

Not all add-ons will disappear, as there are some basic services that consumers will likely prefer to have, such as cleaning and title change services. Maintenance is not tied to vehicle sales but to the number of car owners dropping in for inspections or repairs. At the same Q4 Nov-23 presentation, Nextage commented that gross profit per unit from add-ons rose 10%+ in December from Q4. I am modeling a GPU of Y440k for earnings forecast.

Shareholders and management

The founder CEO Hirota is the largest shareholder and owns 37.4%. T. Rowe Price is the second largest shareholder and owns 14.9%. It raised its ownership from 10.2% at the beginning of 2023 by buying shares at prices ranging from Y1,900 to Y3,000. On the other hand, Capital used to be a 9% owner but seems to have exited completely by September 2023.

As for the board, there are nine board members of whom three are outside directors. The management team (seven people) was paid Y263mn in FYE Nov-22, of which Y228mn was fixed salary.

Dividend policy and share buybacks

Nextage has increased dividends as its net income grew but its payout ratio has been around 10%. It repurchased shares during the pandemic in 2020 but has historically focused on reinvesting free cash flow in its business.

Competition

The largest players in the used car industry are Idom, Nextage and Big Motor.

Idom (7599)

Idom started as a used car buying chain in 1994 by Kenichi Hatori (currently 82 years old) and established itself as the largest buyer by the mid-2000s. The business model was to purchase cars from consumers and sell them through auctions to overseas where demand for high-quality Japanese car was strong. Kenichi passed the baton to his two sons in 2008, Yusuke and Takao Hatori (currently 51 and 52 years old). This also coincided with the time that business saturated as the number of new vehicle sales plateaued. The brothers started looking into new growth avenues and decided to pursue used-car retail and overseas. It is said that the gross profit from retail sales is about 2-3x higher than selling a used car to another wholesaler (source: Toyokeizai). Idom opened its first used-car retail store in around 2010, started a franchise in Thailand in 2014 and acquired an auto dealership in Australia in 2015.

The strategy was not successful. In the international market, Idom exited Thailand in 2017 and sold its Australian dealership in mid-2022. Its only remaining overseas business is Tanzania where the company opened a store in October 2020.

In the domestic market, Idom expanded quickly by rolling out small size used car buying shops. When one sells a car, he is not looking for a large store to sell if he knows that he is getting a fair price. Since Idom had brand recognition as the country’s largest used car buying chain, this worked. Similarly, Idom management initially rolled out small size used car retail shops. The idea assumed that prospective used car buyers would search online first and just needed to pick up the car at the store front. To achieve this, the company needed large inventories (so that search result would return Idom as a seller) combined with many pick up locations. This, however, did not work. Perhaps it was too early as the strategy was implemented in early 2010s. In any case, the feedback the management received from the sales force was that most prospective buyers preferred to test-drive the car before making a purchase.

The next strategy, announced in 2014, was to increase the number of stores through multi-formats, such as high-/low-priced car focused shops, hybrid-vehicle-only shops, import-car-only shops, mini-van-only shops, and others. Idom typically aimed to sell 10-50 vehicles per month from these formats, except large-size stores which aimed to sell 80-100.

This multi-format strategy resulted in cannibalization. Although Idom’s strategy to flood the region with multi-format stores worked to grow revenue, its own stores competed for customers. Even though Idom’s domestic revenue grew from Y167bn in FYE Feb-2014 to Y245bn in FYE Feb-19, its EBIT has stagnated at around Y5-7bn. Adding insult to injury, the pricing policy change Idom implemented in 2018 confused the sales force and its domestic EBIT dropped to Y3.8bn, the lowest level seen in the previous ten years. The policy change was to switch some of the services that were included in the car retail price as optional. The aim was to lower the retail price to appeal to online searches, but the sales force did not necessarily try to sell these options upon car sale.

In April 2022, its first time since 2014, Idom announced a new mid-term plan for 2027. The strategy is to focus on large-size store openings to maximize return on invested capital. The company currently has too many small-/medium-size stores: as of February 2023, it had 192 directly owned retail stores of which 42 are large size, accounting for roughly a third of the retail sales volume. The management aims to have 80 large-size stores by February 2027 by scrapping the small and medium size stores.

More importantly, the company showed commitment to the large-size store strategy. It announced the sale of its Australian car dealership. The company has been exiting non-core businesses, such as the Thai auto dealership in 2017 and the domestic new car dealership in 2021. Exiting from Australia completes the disposal of businesses unrelated with domestic used car sales.

Another interesting announcement was to use ROIC as a KPI. Idom has not historically calculated ROIC to make investment decisions, which resulted in not closing medium size stores if they were not losing cash even though the return was presumably below the cost of capital. The company targets ROIC of >10% (it was 11.6% in FYE Feb-23). The management explained that sharing this KPI is important for all employees to understand management decisions. For example, the sales team would like to carry as many inventories as possible to avoid opportunity losses, but the finance team would want to minimize inventories to improve working capital. Sharing ROIC helps them work together.

Given the history of the management underdelivering, investors haven’t really touched the company which trades at a valuation 30% discount to Nextage’s: 8.2x and 7.8x TTM EV/EBIT and P/E. Idom has the potential to keep growing its revenue and profits in mid-teens if it executes strategy successfully. However, I recently exited this name because I question the management’s guidance (SG&A, over which the management should have control, seemingly running too high to hit its profit guidance) and because Idom did not sell as many cars as it had planned in Sep-Nov 2023, its Q3. The latter could be an industry-wide phenomenon as consumers shied away from large chains after reading business malpractices. But the sales volume in Q3 was disappointing to me as Idom was the only major retailer that was not hit by negative media coverage. Idom management set a high bar to meet Q4 guidance and I am afraid that the company will fall short again when it announces full-year earnings in April.

As for shareholder structure, the founding Hatori family owns 37%. Big Motor, described below, used to own more than 5% of the company but exited completely in 2023 to deal with its own financial distress.

Big Motor

Big Motor was founded by Hiroyuki Kaneshige in 1976 when he was 25 years old. He started the business in Yamaguchi prefecture, where he was born, and opened new stores in Western Japan until early 2010s when he started expanding in Eastern Japan, mainly Tokyo and its vicinity. The company is privately held and information is limited but according to its website, it has more than 300 shops nationwide with sales of Y700bn+ and 6,000+ employees. This compares to Idom’s employees of 5,150 and Nextage’s 6,282.

Big Motor’s business strategy also focuses on opening large-size stores to retain customers throughout the life cycle of a car. Big Motor appears to be interested in acquiring car dealers whereas Nextage and Idom have grown organically.

The company is on the edge of bankruptcy since its insurance fraud was widely reported. Based on what I read, the root cause was the incompetent son of the founder trying to prove himself to other senior executives (they were whispering nepotism) by enforcing strict quotas. The son was promoted as the CEO in 2016. The company is said to be in the process of a sale and Itochu (8001) is the top bidder. Idom was reported to be a serious bidder but dropped out.

Valuation and target price

Nextage has traded at 15-16x TTM EV/EBIT and 15-20x P/E in the last five years. Presuming that (i) the company can continue to grow retail sales volume at low- to mid-teens, and (ii) it will maintain operational efficiencies (its incremental SG&A per additional employee is around Y8.5mn, whereas SG&A per employee is around Y10-11mn, primarily driven by reduced A&P spending), Nextage’s EBIT can grow at around 20% annually.

I expect Nextage to earn Y22bn of EBIT in FYE Nov-24 and Y26.7bn in FYE Nov-25. By assigning 13-15x EV/EBIT, its share price is worth Y2,990-Y4,400. Based on my model, this fair value is roughly equal to 15-18x P/E.

Disclaimer:

The information provided here is for general informational purposes only and should not be considered as professional financial advice. The content is based on the author's understanding and interpretation of financial markets, economic trends, and various other factors.

Investing involves risks, and past performance is not indicative of future results. The author or provider of this information is not a licensed financial advisor and does not guarantee any specific outcome or profit. It is important to do your own research and consult with a qualified financial professional before making any investment decisions.

The information presented may not be suitable for all investors and is not tailored to individual investment objectives, financial situations, or risk tolerance. All investors should carefully consider their own financial situation and consult with their financial advisor before making any investment decisions.

The author and the platform providing this information are not responsible for any losses, damages, or liabilities that may arise from the use of the information provided. The user assumes all risks associated with their investment decisions.

Investing in financial markets involves the risk of loss, and past performance is no guarantee of future results. The user is solely responsible for evaluating the risks and merits associated with the use of any information provided and should seek advice from a qualified financial professional.

By accessing and using this information, the user acknowledges and agrees to the terms of this disclaimer.