Investment Summary

Despite its competitive advantage in human resource management and strong top line growth, Plus Alpha Consulting’s (PAC) share price has remained sideways since its IPO in June 2021. I think its high valuation at the time of the IPO and small market cap ($700mn at this writing) makes it fall under the institutional investors’ radar. However, PAC is a software business that is growing ARR at 30%+ annually over the last four years, operates in a nascent business domain which is replacing human resource tasks managed by Excel, and leads peers on human resource management using text mining, while being highly profitable with ROIC of >150% (high margins + little capex requirements). The company has good English disclosure and I think it can fetch a higher valuation if my premise that PAC has a long runway for growth is correct. Thanks to its revenue and earnings growth, the current trading multiple of 2024E 19.6x EV/EBIT and 31.4x P/E looks like a reasonable entry point for investors with a time horizon of three years or more. My target price is Y4,200 by the end of 2026, about 75% higher than the current price. This translates to c.22% annualized return over the next 2.8 years.

Risks

The development of artificial intelligence (AI) may make text mining obsolete. One may be able to plug in unstructured data to AI and obtain similar results to Plus Alpha Consulting’s proprietary text mining analysis. Currently, the cost (computing power) will be the barrier because text mining feeds data to AI in an easier-to-understand way, making the information digestion faster. However, in the future, AI may not need such preparation to low the running cost.

Human capital management software for basic needs, such as work hours and payroll is a commoditized area. PAC’s solutions appeal to customers who try to manage their human capital with deep insights. If that appeal is not strong enough for prospective customers, PAC’s revenue growth will stall.

Business description

Although human capital management software is the main driver of PAC’s business, its core competency is in analyzing unstructured data. The company was founded in 2006 by Katsuya Mimuro and Kenji Suzumura, who worked at Nomura Research Institute (4307) and developed True Teller which provides customer relationship management (CRM) services using text mining to analyze customer feedback. PAC’s first (and still ongoing) product was Mieruka-Engine, which means visualizing customer feedback. This product runs text mining on social media to gather customer feedback. It was not until 2016, when PAC launched Talent Palette, human capital management (HCM) software, that revenue growth skyrocketed. The genesis was to manage PAC’s own human resources more effectively, but after noticing the market opportunity, the company decided to release it to the public.

All the services PAC offers are subscription services which accounted for 90% of the total revenue for the fiscal year ending (FYE) September 2023. Thanks to its low churn rate (0.5% monthly or 5.8% annually), PAC’s revenue is highly predictable. HCM business (mainly Talent Palette) accounted for 68% of total revenue and 70% of EBIT for FYE September 2023, and this ratio is likely to go higher as the business is growing faster than other products, which are in marketing and education.

Human capital management software

What is human capital management? It is to manage everything human resources such as work hours, payroll, and work history. Many companies have managed such information in Excel by division and/or by subsidiary, and demand for a unified database was strong. The field can be described as relatively low entrance barrier for service providers but high switching cost for users, as migration of large volume of data from one software to another is cumbersome. While HCM software has been around in the US for a long time (Workday, for example), the take-up of foreign-made software has been low due to local customization requirements. Aneel Bhursi, Workday’s founder, mentioned in a 2014 call that rolling out HCM software globally is hard because “the uniqueness country by country is much tougher in HR than there is for Financials, especially as you get near areas like absence and payroll”. I also suspect that demand for such services was still small back then and did not justify Workday investing its resources.

There are many domestic HCM software vendors that can support companies with >1,000 employees. Besides PAC, the major listed companies in this field are Visional (4194), Kaonavi (4435), Freee (4478), and Money Forward (3994), though the latter two are known for accounting software targeting small- and medium-size businesses. When it comes to the basic functions of HCM such as attendance, payroll and work history management, PAC is reviewed positively for its wide coverage (i.e., a one-stop solution) and a successful installation track record among large corporations. On the surface, PAC does not appear to have a competitive advantage, but I believe it has two. First is its large customer base and business support strategy. Like Bloomberg, the company actively seeks feedback from clients and upgrades functions regularly. This improves user experience and attracts more customers, from which PAC can seek more feedback. PAC has added 4,700 functions to its HCM software over the last seven years.

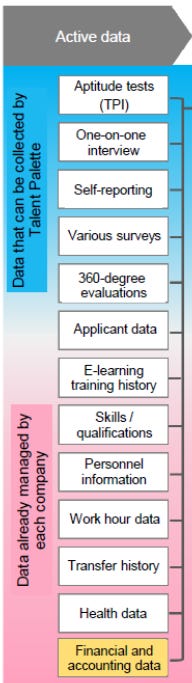

The second is PAC’s ability to analyze unstructured data through text mining. Many basic HCM requirements are structured data, meaning that there is one answer to a question/label: how many days an employee took off, and how much salary was paid, among others. Structured data is easy to organize, which is why companies have historically used Excel. On the other hand, unstructured data includes emails and free-form employee feedback. This is a lot harder to organize and analyze. For example, one can focus on the word ‘like’ but the meaning will be different depending on the context (‘I like’ vs. ‘I don’t like’). In addition, the language is in Japanese and English text mining tools cannot be applied. PAC touts that its text mining can identify motivated employees who are willing to switch to new posts as well as employees who are on the verge of resigning, by analyzing what these kinds of employees have historically written in feedback forms. These tools are more useful to large corporations which have harder times tracking all the employees. The chart below from PAC’s investor presentation shows how the company understands its competitive strength: analyzing qualitative information, such as surveys and interviews. Structured data is grouped in the bottom.

Source: PAC investor presentation

The table below compares the subscriber numbers, monthly average revenue per user (ARPU), and churn among the three listed major HCM software providers: PAC’s Talent Palette, Visional’s HRMOS and Kaonavi. PAC has the highest monthly ARPU among the three, reflecting its focus on selling sophisticated solutions to large corporations. Companies with more than 1,000 employees accounted for 40% of Talent Palette’s subscriber base as of September 2023, whereas it was 16% for Kaonavi. Selling to larger enterprises helps push up ARPU because PAC charges based on the number of employees.

Market size for human capital management

According to the 2021 Census by Ministry of Internal Affairs and Communication, there were 3.7 million enterprises in 2021, of which 4,628 had more than 1,000 employees. As mentioned above, Talent Palette had about 590 (=1,473 x 40%) customers with >1,000 employees as of December 2023. In its mid-term plan, PAC forecasts to have 2,970 customers by September 2027. If 40% of those customers remain >1,000-employee companies, PAC will need to have c.25% (=2,970 x 40% / 4,628) of the >1,000 market.

Another factor is the ARPU. Though the average monthly ARPU was Y402k for the quarter ended September 2023, PAC commented in the past that largest clients pay ~Y3mn/month. I suspect the higher ARPU comes from both a large subscriber (employee) base and cross-selling.

Shareholders and management

The two founders own 37% of the total shares. Nomura’s private equity arm used to own 37% pre-IPO (PAC was listed in June 2021) but sold down completely by July 2023. One can potentially argue that the selling pressure/concern from a large holder put a lid on the share price, though PAC’s share price has remained sideways even after its exit. One notable owner is Fidelity, who owns 5.6% as of February 2024, down from 6.7% in August 2023.

All the board members are paid by base salary only and there is no performance-linked payout or stock incentive. Despite the high founder ownership, it raises a question how serious PAC is to raise shareholder value.

Valuation

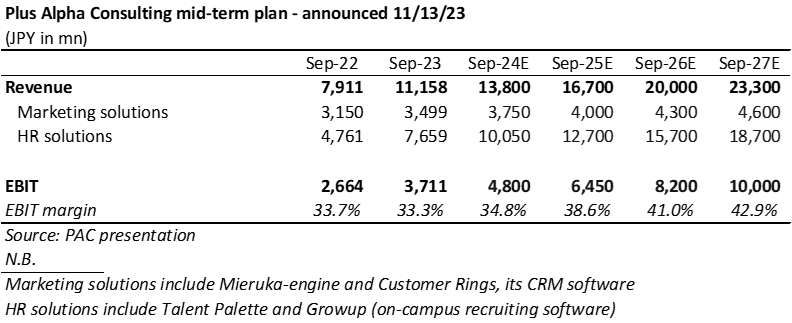

I estimate PAC’s fair value at about Y4,200-4,900 by using the FYE Sep-27E profit guidance. Currently, the company trades in line with Visional and Kaonavi, other major HCM companies who have had similar revenue and profit growth rates, as the table below shows.

While the historical numbers look similar, I expect PAC to grow faster and enjoy strong operating leverage in the next three to five years.

Kaonavi’s revenue growth has decelerated this year from 30%+ in previous years to the high 20s. As noted previously, this comes from increasing competition with larger players (e.g., Visional, Freee and Money Forward) offering similar services at comparable price points. I expect Kaonavi’s top line growth to continue slowing down. On the other hand, PAC”s HCM software business is expected to grow at 25% for the next four years, though the consolidated revenue growth is slower due to slow-growing marketing solutions segment which accounts for roughly 30% of the total.

While Visional’s EBIT growth is impressive, there are a few factors to consider:

Visional’s core business is Bizreach, a recruiting website catered to mid- to senior- level professionals, and its HCM software generated Y2.9bn of revenue for the 12M ending January 2024, accounting for 4.8% of the companywide revenue. This compares to Y6-7bn of annual revenues PAC and Kaonavi book from their respective HCM software. Though revenue growth rate is high, the year-over-year yen value increase in its HCM software revenue is around Y400mn quarterly, lower than PAC’s or Kaonavi’s at around Y500mn.

A large part of that 82.2% three-year EBIT CAGR was driven by Visional exiting or shrinking unprofitable businesses. Bizreach’s segment EBIT margin (management accounting, before allocating corporatewide costs) rose from 34.9% for FYE July 2018 to 42.5% in TTM January 2024. While Bizreach shows impressive operating leverage, it was not the main driver for that 82.2% CAGR. Going forward, I expect Visional to see EBIT growth in line with revenue growth, which the company targets at 15-20%.

Bizreach’s revenue generation is based on the number of successful job placements. One of the reasons investors have not given a higher multiple despite its growth is the fear of recession/economic slowdown that will affect job placements. On the other hand, PAC’s revenue is more likely to be sticky as it is related to the number of employees a customer has.

Presuming that PAC reaches Y23.3bn of revenue and Y10bn of EBIT by FYE September 2027 as the company guides, by applying 17x EV/EBIT we can calculate that the share is worth about Y4,200, roughly 75% above the current price (or Y4,900 if 20x EV/EBIT is applied). If PAC reaches this share price by the end of 2026, the expected annualized return is c.22%.

Disclaimer:

The information provided here is for general informational purposes only and should not be considered as professional financial advice. The content is based on the author's understanding and interpretation of financial markets, economic trends, and various other factors.

Investing involves risks, and past performance is not indicative of future results. The author or provider of this information is not a licensed financial advisor and does not guarantee any specific outcome or profit. It is important to do your own research and consult with a qualified financial professional before making any investment decisions.

The information presented may not be suitable for all investors and is not tailored to individual investment objectives, financial situations, or risk tolerance. All investors should carefully consider their own financial situation and consult with their financial advisor before making any investment decisions.

The author and the platform providing this information are not responsible for any losses, damages, or liabilities that may arise from the use of the information provided. The user assumes all risks associated with their investment decisions.

Investing in financial markets involves the risk of loss, and past performance is no guarantee of future results. The user is solely responsible for evaluating the risks and merits associated with the use of any information provided and should seek advice from a qualified financial professional.

By accessing and using this information, the user acknowledges and agrees to the terms of this disclaimer.

Great writeup. Any thoughts on the recent drop after earning release? The results seemed pretty good to me. Maybe it's the slightly lower revenue growth due to seasonality that Mr. Market didn't like?